25+ accounts receivable process flow chart

48000 2900 1655. The amount of cash or cash-equivalent which the company receives or gives out by the way of payments to creditors is known as cash flow.

Operating Cash Flow Formula Examples With Excel Template Calculator

An asset to a customer.

. Our Explanation of Accounts Payable provides insights on the bill paying process in a large company. The following information will provide an overview of the Collection Process for Delinquent Taxes. Accrual accounting uses invoice processing to both procure and offer services on a credit basis rather than requiring payment.

Including a monthly closing process in your regular accounting procedures ensures that your numbers are reliable stable and accurate. Exhibit 5191-3 ACS Call Flow IPU 19U1021 issued 09-09-2019. For that year we add the beginning and ending accounts payable amounts and divide them by two.

Then you can use the accounts receivable days formula to work out your total as follows. This chart of accounts is suitable for use with US GAAP. The use of the cash receipts journal is a three step process.

Removed hyperlink to Telephone Transfer Guide from paragraph 3 in first row of table and replaced with hyperlink to IRM 51913 Referrals and Redirect. To get the average accounts payable for XYZ Inc. Included are discussions of the three-way match early payment discounts end of period accruals and more.

Exhibit 5191-3 ACS Call Flow IPU 19U0039 issued 01-07-2019. It is not directly affected by the journal entry write-off. Part 1 Introduction to Accounts Payable An Account Payable is Another Companys Account Receivable Part 2 Accounts Payable Process.

Cash flow analysis is often used to analyse the liquidity position of the company. The cash receipt journal line items are used to update the subsidiary ledgers such as the accounts receivable ledger. Graphs are the subset of the charts as the charts are the larger version of the same.

Flowchart for Month-End Close Process. Information is recorded in the cash receipts journal from the appropriate source documents such as bank paying-in books bank statements and advice slips. A listing of each account a company owns along with the account type and account balance shown in the order the accounts appear in the companys financial statements.

The exact steps in the month-end close process may vary from company to company depending on the type of accounts and transactions that make up its financial data. Penalty charges can range from 25 to 500 of the tax due depending on the type of the tax. It gives a snapshot of the amount of cash coming into the business from where and amount flowing out.

Chart Of Accounts. The next periods transactions are added to the balance brought down and at the end of the period the balancing off accounts process is repeated. Updated Example tax years throughout.

After writing off the bad account on August 24 the net realizable value of the accounts receivable is still 230000 238600 debit balance in Accounts Receivable and 8600 credit balance in Allowance for Doubtful Accounts. In contrast the chart as stated earlier is a type of graphical representation of the information or the data in which the data that is represented by the symbols like the lines in a line chart bars in the bar chart or the slices in a pie chart. Accounts payable only applies to businesses that use the accrual basis of accounting not cash-based accountingThis is because the accrual method of accounting records income and expenses when they are invoiced and paid.

The Bad Debts Expense remains at 10000. In contrast IFRS 1531 ASC 606-10-25-23 state. The balance on a permanent account continues to the next accounting period.

Imagine Company A has a total of 120000 in their accounts receivable along with an annual revenue of 800000. Explore software integrations with Clio the worlds leading legal practice management solution in the extensive Clio App Directory. If the accounts receivable account used above is followed through to the next accounting period it would look as follows.

Lets look at an example to see how this works in practice. Accounts Receivable Days Accounts Receivable Revenue x 365. If you have been contacted by the Michigan Accounts Receivable Collection System MARCS please contact them directly for more information about.

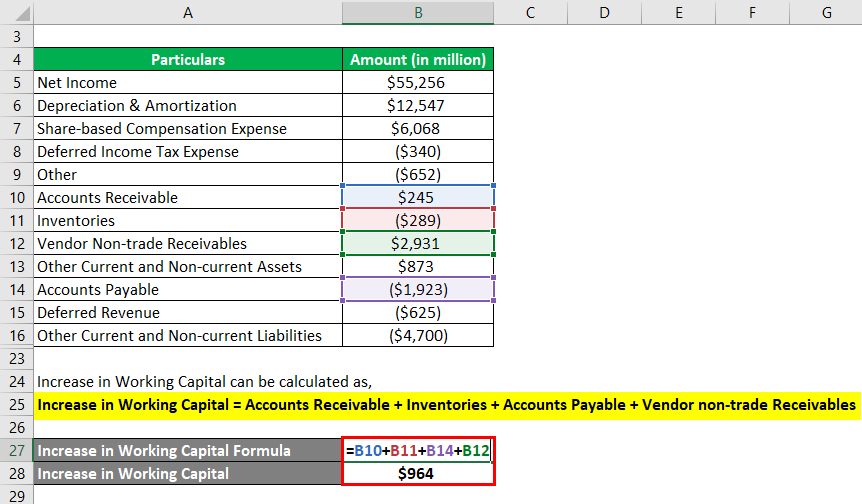

An entity shall recognize revenue when or as the entity satisfies a performance obligation by transferring a promised good or service ie. To calculate the accounts payable turnover ratio we then divide total supplier purchases 48000 by average accounts payable 2900.

Sec Filing American Airlines

Slide 25 Jpg

What Is A Unicorn Company The Top 25 Unicorns Business Models For 2022 Fourweekmba

20 Free Balance Sheet Templates In Ms Excel And Ms Word Besty Templates Balance Sheet Balance Sheet Template Balance

25 Kpis And Metrics For Finance Departments In 2021 Insightsoftware

Testing Weekly Status Report Template Professional Sample Project Status Report Sazak Mouldings Progress Report Template Project Status Report Report Template

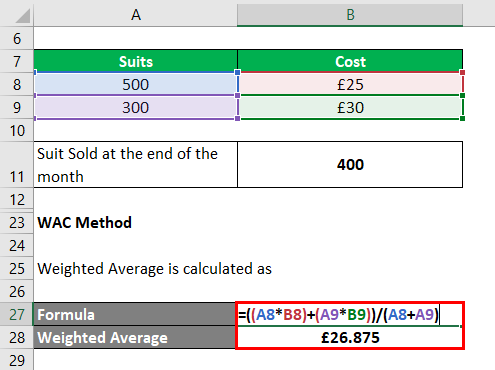

Inventory Valuation Methods Types Advantages And Disadvantages

Ex 99 1

Investorpresentation

Inventory Valuation Methods Types Advantages And Disadvantages

425

The Charming Daily Status Report Template Software Testing 15 Things Within Testing Daily Status Progress Report Template Project Status Report Report Template

Fresh Certificate Of Origin Template Word Certificate Of Completion Template Certificate Templates Certificate Of Origin

Financial Advisor Resume Examples And 25 Writing Tips

Bookkeeper Cv Examples And 25 Writing Tips

Granahan Mccourt Acquisition Corp 2008 8 K Current Report

Sunlight Financial Holdings Inc Ipo Investment Prospectus S 1 A